The U.S. plant-based food industry faced a challenging year in 2025, with several high-profile brands experiencing closures, restructures, or discontinuations. These events were not necessarily due to a drop in consumer interest but rather, they reflect a market reset where only the most resilient, adaptable brands may thrive.

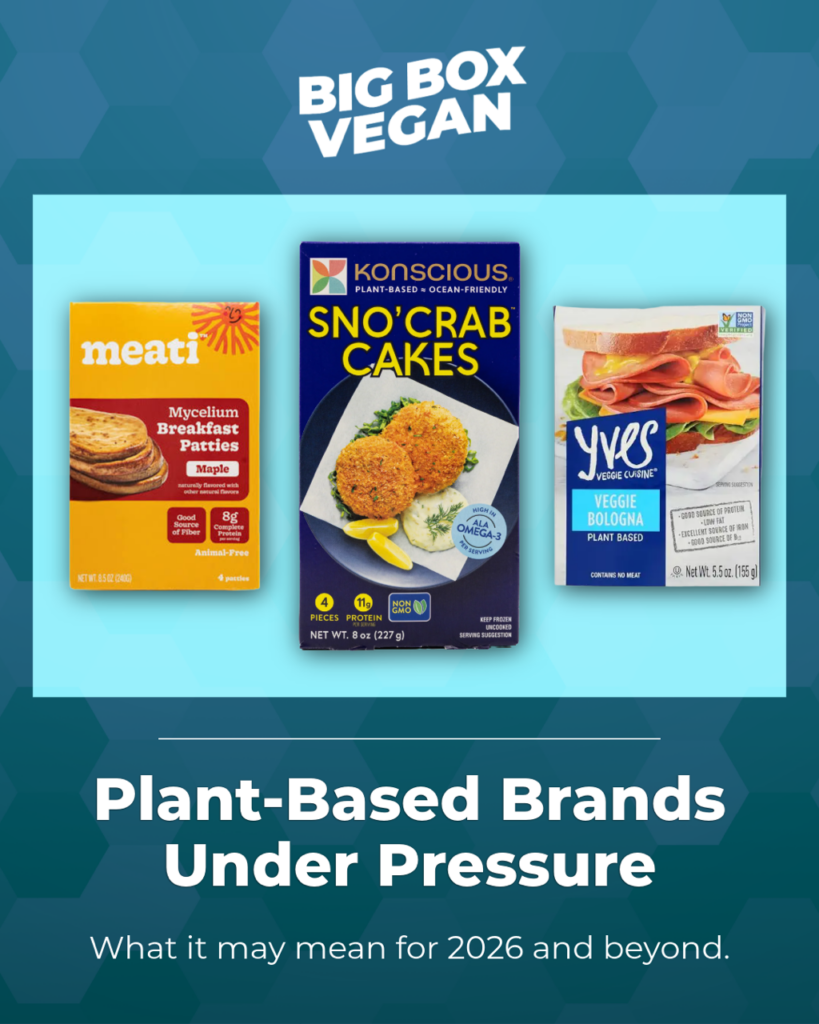

Among the most notable cases are Konscious Foods, Meati Foods, and the legacy brand Yves Veggie Cuisine. Together, their stories illustrate both the challenges and opportunities facing plant-based products in the U.S.

Konscious Foods Shuts Down Operations

Founded in 2020 by plant-based pioneer Yves Potvin (Yves, Gardein brands) Konscious Foods aimed to crack one of the industry’s most challenging categories, plant-based seafood. The brand gained national U.S. distribution with frozen vegan sushi, onigiri, and seafood-inspired meals.

As recently as March 2025, Konscious Foods was exhibiting at Natural Products Expo West, debuting new products like vegan crab cakes, smoked salmon and crispy shrimp, signaling continued expansion. I even found their newer products this past fall at Sprouts Market, but just a few months later the company quietly ceased operations as of December 2025.

According to recent news reports, the shutdown followed enforcement action by its primary secured lender amid tightening capital and rising operational costs. The company’s website and contact channels have since gone offline, which seems to confirm a halt to operations.

Konscious Foods’ closure highlights a growing reality that even well-reviewed, innovative products can struggle when margins, logistics, and financing don’t align especially in frozen and prepared foods.

Meati Foods: A 2025 Meltdown but a 2026 Rebuild?

Meati Foods, known for its mycelium-based whole-cut protein, experienced a major financial crisis in March 2025. Despite raising roughly $450 million and expanding across thousands of U.S. retail locations, a sudden lender action swept much of its cash, triggering layoffs and threatening production.

It’s been reported that the company and its assets were sold for a fraction of its prior valuation but unlike Konscious, Meati is now under new ownership, emerging debt-free and planning a rebrand and market relaunch in 2026, including participation at NaExpo West in March 2026 according to their website.

Meati’s story illustrates that restructuring can offer a second chance, even after severe financial setbacks but what the future may hold for them remains uncertain.

Yves Veggie Cuisine: The End of a Legacy Era

The discontinuation of Yves Veggie Cuisine in 2025 marked the end of a decades-long chapter in vegan food. Founded in the 1980s by Yves Potvin, Yves Veggie Cuisine helped define the original vegan meat category. Its discontinuation was driven by declining sales and corporate decisions, rather than a lack of consumer interest, making it a symbolic moment alongside Konscious’ shutdown.

Why 2025 Was So Hard

Several factors converged to create a challenging environment for plant-based food in the U.S.:

- Capital Got Tighter. Investors and lenders shifted focus to near-term profitability rather than growth at all costs.

- High Operational Costs. Ingredients, labor, and logistics remain more expensive for plant-based foods, especially frozen or prepared products.

- Retail Rationalization. Grocery stores trimmed slower-moving SKUs, disproportionately affecting niche or premium vegan products.

What 2026 May Hold

While 2025 was a turbulent year, the plant-based industry may be resetting rather than collapsing. The next year may reveal which brands are truly resilient and which products and categories resonate with consumers.

Smarter, Leaner Brands

Surviving companies are expected to focus on core products, streamlined operations, and sustainable margins. Meati’s restructuring may show one path forward that emerging leaner may lead to success.

Innovation Continues but With a New Lens

Even as Konscious Foods closed, plant-based seafood and alternative protein remain high-interest categories. 2026 may bring taste-driven, targeted innovation rather than experimental products reliant on hype alone.

Consumer Expectations Are Higher

Shoppers are seeking products that taste great, are convenient, and offer good value. Brands meeting these expectations whether new or legacy-inspired will likely perform best.

Uncertainty Means Opportunity

The future remains uncertain, but this uncertainty creates space for resilient, strategic brands to emerge stronger. 2026 could be the year the next wave of plant-based leaders takes shape.

In short, 2025 was a reality check but 2026 may be the rebuild. The struggles of Konscious Foods, Meati Foods, and Yves Veggie Cuisine may not signal the end but instead, they may mark a turning point, one where innovation might be matched with sustainable business models. Let’s hope 2026 is brighter but it remains to be seen.